For every business, the budgeting process starts with a sales forecast or a profit expectation, the top or bottom line. Sales projections reflect both: production (or procurement) of an item and the nature of the market. Production capacity does not necessarily lead to a sale, and the experiences of the auto companies are a good example of this rule. Similarity, though, it is hard to sell from an empty wagon.

Knowing what expenses to expect is part of the management process. Once you can compare to prior years’ operating numbers, this activity is much easier than when starting up a new company. Having access to industry averages can help, but you should remember that being average is just that. Expenses can be divided into two broad categories; administrative and production.

Some administrative costs are easily determined. You can easily ascertain insurance, licenses, interest, depreciation, office utilities, phone, auto expense and rents. Researching will at least provide a best guess. The marketing plan will drive advertising, printing and postage costs. Office labor expense and its related charges (payroll tax, retirement benefits, unemployment and employee insurance) will be a result of the expected personnel needs. Legal and accounting services are a function of contracted services. Contributions, office supplies, travel and repairs are areas that you can control with a rolling budget. This would result in at least 90% of administrative costs having a valid number attached to them in the budget forecasting process. These are fixed costs and would be incurred regardless of the production level.

Cost of Goods Sold (COGS) is direct production cost and is unrelated to the sales level. Raw material input and labor along with other costs directly related to production make up the COGS. You can determine raw material costs by adding the beginning inventory with the purchases made and subtracting the ending inventory. Labor costs include payroll tax, retirement benefits, unemployment and employee insurance. Supervisory production labor is also included. Packaging, shipping and other directly related to the sales level costs are part of the COGS.

Knowing market conditions will lead to a ceiling price, the most the market will bear. COGS plus fixed expenses will determine the floor price of sales needed. Managing the price between the floor and the ceiling will produce a profit and should at the same time render sufficient volume of sales to meet fixed expenses. Once a price has been determined, the percentage of each sale for variable costs can be found by dividing the COGS by the sales price. Subtract this percentage from 100% of the sales price to yield the margin on each sale.

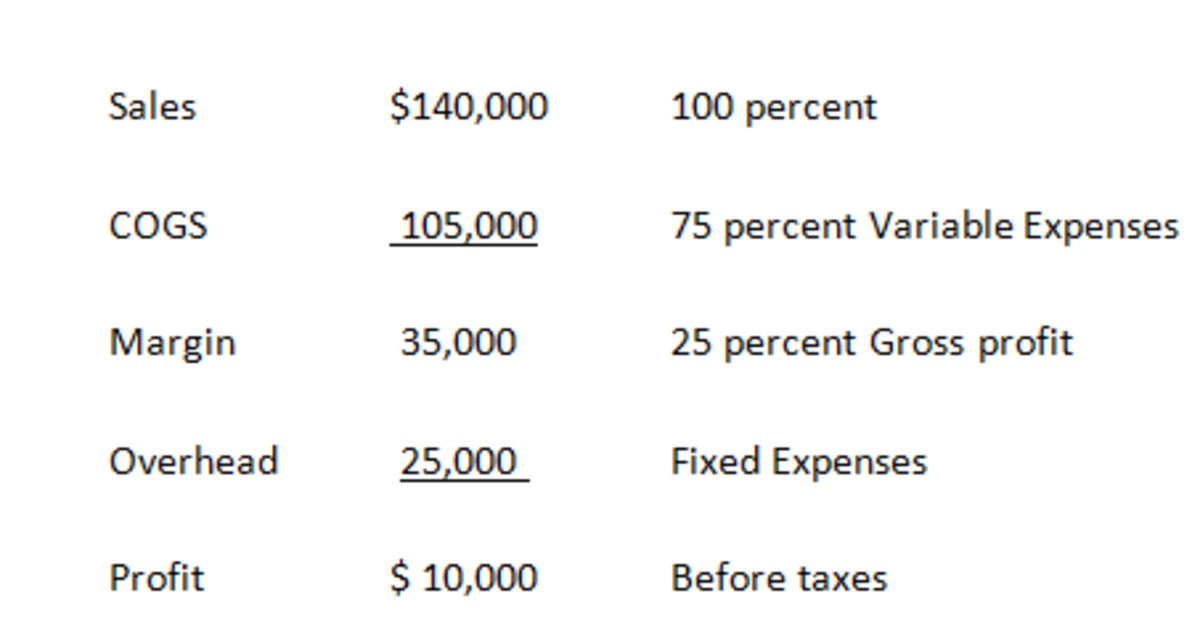

For example, if COGS are 75% then the margin is 25%, twenty-five cents of every dollar can be used to cover overhead expenses. If in this example overhead is $25,000, then the floor price (breakeven) is $100,000. Simply divide the overhead by the margin of each sale dollar ($25,000/$.25). Every dollar of sales over the breakeven level of $100,000 will result in a twenty-five cent profit. Assuming the company needs to generate of profit of $10,000, the needed sales level above breakeven can be calculated by dividing the needed profit by the margin percentage ($10,000/.25) or $40,000. Added to the floor price breakeven level of $100,000 would provide the sales manager with a targeted sales level of $140,000.

The operating statement would look like this:

This article was provided by Michigan State University Extension.